Affordable Burial Insurance For Seniors.

It’s not a pleasant thing to discuss, but end-of-life expense costs have become astronomical for the average American. End of life costs are known as final expense or burial coverage.

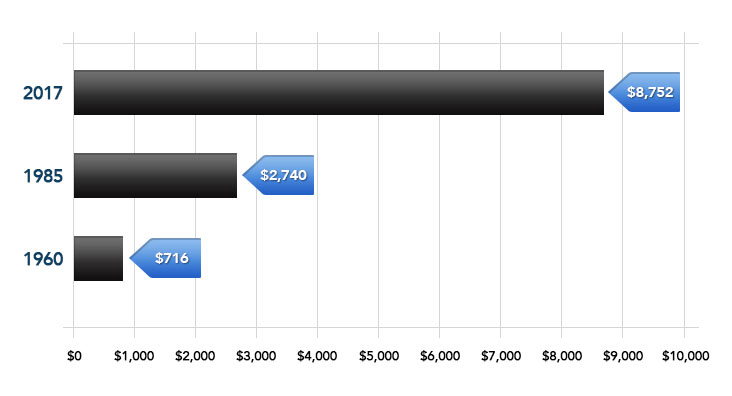

The price of attending to and burying a loved one has increased by over 1200% in the last 60 years and almost 320% in the last 30 years.

National Final Coverage is designed to help provide affordable burial coverage for seniors, to help cover these unplanned bills that your family would otherwise incur after your death.

Get a Free Quote!

Burial insurance is different than your typical life insurance policy,

as life insurance doesn’t provide an immediate benefit, often taking months and much paperwork. Most people don’t have $10,000 lying around at the time of a typically unplanned death of yourself or a loved one, so final expense insurance is a great way to guarantee you are protected against costly medical bills and funeral expenses. These costs often create even more stress and grief to an already challenging situation.

Facts are facts, but most people still wonder why they need final expense insurance. Here are some key points as to the benefits of a typical Final Expense Policy.

- Coverage options range from $2,500 – $100,000

- Payment is issued within 24-48 hours after a death

- Family beneficiaries can typically use the money for any purpose

- Best for Seniors but policies can be provided for those 25-80 years old

- Premiums are often for low double-digit monthly amounts and do not increase

The benefits are great, but does it make sense to take out a policy

if I have term life insurance?

As you get older, and your kids leave home, most people abandon their term life insurance policy. Term life policies are used to help a spouse or family member pay for a home, replace job income, pay for college and more in the event of an untimely death. Upon retirement age in your 50’s and 60’s, most of these big-ticket items have been paid for. At this point, you are left with no insurance coverage and must adapt to life on a smaller fixed income. Therefore, it makes financial sense to get even a small final expense insurance policy to cover the anticipated $9,000-$10,000 in funeral and other end of life type expenses down the road.